The application period for the Credit for Contributions to Scholarship Organizations program will begin on July 1, 2013.

The credit is for approved business entities that make contributions to approved scholarship organizations.

Although the contribution must be made by a business entity, the credit can be used against a variety of taxes, including the business corporation tax, the public service corporation tax, the tax on banks, the bank deposits tax, the tax on insurance companies, and the personal income tax. (Owners, shareholders, or partners of pass-through entities

Wednesday, June 26, 2013

Thursday, June 20, 2013

Cyber Security For Small Business Seminar

On Friday, June 28, you are invited to attend the seminar entitled Cyber Security For Small Business. This seminar will be presented by the U.S. Small Business Administration, NIST, FBI, and SCORE. It will be held at Amica Insurance, Joel Tobey Amphitheater, 100 Amica Way in Lincoln from 8:30am – 12:30pm and is free of charge. To register, email matthew.spoehr@sba.gov or call 401-528-4561

On Friday, June 28, you are invited to attend the seminar entitled Cyber Security For Small Business. This seminar will be presented by the U.S. Small Business Administration, NIST, FBI, and SCORE. It will be held at Amica Insurance, Joel Tobey Amphitheater, 100 Amica Way in Lincoln from 8:30am – 12:30pm and is free of charge. To register, email matthew.spoehr@sba.gov or call 401-528-4561This seminar will help small businesses increase information system security. Learn how to define information security for your organization and common best practices to protect your data. Hear about threats, current technologies and free resources available to protect your business.

Wednesday, June 19, 2013

Reminder FBAR Due Date is June 28 This Year

This is a reminder of the due date of the FBAR. The annual TD F 90-22.1, Report of Foreign Bank and

This is a reminder of the due date of the FBAR. The annual TD F 90-22.1, Report of Foreign Bank and Foreign Accounts (FBAR) is due June 30. This “due date” is the date the FBAR is required to be IN THE HANDS of the Treasury Department. There is not a “postmark rule” when it comes to the filing of the FBAR.

This year June 30 is on a Sunday. Since this is a Treasury form and not an IRS form there is NOT a “next business day” rule when it comes to filing of FBARs. Therefore the FBAR has to be in the hands of the Treasury Department by Friday, June 28, 2013, in order to be timely.

- This post has been shared with you courtesy of: David & Mary Mellem, EAs & Ashwaubenon Tax Professionals, 920-496-1065

Thursday, June 13, 2013

Nominations Update

Our Board of Directors has four expiring terms at the end of 2013. They are as follows (Regions and their corresponding counties can be found in the board of directors section of our website). Nominations and elections are held at our Annual Meeting each October.

Region 1—Christine Miarecki (current, expiring, will re-run if nominated)

Region 2—Pamela Marcinowski (current, expiring, will not re-run)

Region 3—William Delaney (current, expiring, will re-run if nominated)

Region 4—Stephen Garvey (current, expiring, will re-run if nominated)

If you are interested and would like to run for a position in any region on our board, please contact Paul Malone, EA (Nominations Chair) at mba3@mindspring.com or 401-333-1118.

Region 1—Christine Miarecki (current, expiring, will re-run if nominated)

Region 2—Pamela Marcinowski (current, expiring, will not re-run)

Region 3—William Delaney (current, expiring, will re-run if nominated)

Region 4—Stephen Garvey (current, expiring, will re-run if nominated)

If you are interested and would like to run for a position in any region on our board, please contact Paul Malone, EA (Nominations Chair) at mba3@mindspring.com or 401-333-1118.

You Can Cheat the Tax Collector and Get Away With It, But...You Must Pass Into The Next Life In Order To Do So, And What About The Spouse Who is Still Alive and Well?

A fourth marriage, an involuntary bankruptcy, a secret divorce and reconciliation, an erroneous federal tax

A fourth marriage, an involuntary bankruptcy, a secret divorce and reconciliation, an erroneous federal taxrefund of almost $600,000 deposited into an out-of-country bank account, an unexpected death (shortly after the federal government filed suit), and an Ontario fishing lodge! This is the kind of tale which mystery writers love to develop, and we have it free of charge courtesy of the United States District Court for the District of Minnesota. Your editor had previously thought that MN was populated only by thoroughly righteous persons; now he isn’t so sure.

Fred and Jo Anna Bame entered into an antenuptial agreement (aka a prenuptial agreement) which provided for separate ownership of property “free and clear of any and all claims by the other party.” The couple

RI Affirms MA Same-Sex Marriage as Recognized Under State Law

Chapter 22, Title 44, Sec. 44-22-1(e) of the estate tax code provides for an estate tax marital exclusion similar to the federal marital exclusion. The Rhode Island Civil Unions Act (7/1/11) “provides that a party to a civil union shall be included in any definition or term that denotes the spousal relationship as those terms are used throughout Rhode Island law, whether or not the terms are gender specific. Sec. 15-3.1-6 of the Act further states that parties to a civil union shall have all the rights, benefits, protections and responsibilities under the law as people joined together in a lawful marriage in the State of RI.” (RI Declaratory Ruling 2012-02).

When It's Too Good To Be True, It Usually Is Not True! However, There Are Occasional Exceptions To That Rule, So Read On...

We all know the general rule…Your resident state must allow a credit for tax paid to another state on income taxed by both states. The devil is in the details. Consider these examples:

We all know the general rule…Your resident state must allow a credit for tax paid to another state on income taxed by both states. The devil is in the details. Consider these examples:- Taxpayer lives in MA (files MA resident return), and works part-time in RI (files RI NR return to report wages from RI employment). His RI NR tax is $350. The MA tax on the same income is $325. He is entitled to a credit on his MA resident return (Schedule Z) in an amount not to exceed the MA tax on that income, so his MA credit for tax paid to another state is $325.

- Taxpayer lives in MA (files MA resident return), and works part-time in VT (files VT NR return to report wages from VT employment). His VT NR tax is $300. The MA tax on the same income is $325. He is entitled to a full credit of $300 on his MA resident return (Schedule Z).

Another Incorrect Independent Contractor Classification Bites The Dust!

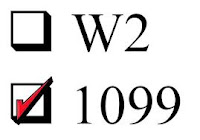

ASUI Healthcare of Texas, Inc. hired “direct care specialists” to work at group residences. No prior experience or special skills were required. ASUI classified the workers as independent contractors; they were issued form 1099Misc; they worked fluctuating hours, but were not paid overtime for hours in excess of 40 per week.

Long-term employees Vera Chapman (almost 2 years) and Krystal Howard (almost 4 years) sought unpaid wages (failure to pay the minimum wage and overtime).

ASUI argued that they did not control the details of the work and that the 1099Misc form designated them as “non-employees” thereby raising a factual dispute as to their employment status. Your editor found that to be particularly interesting---an employer claiming that if we issue a 1099Misc instead of a W-2, it creates a dispute in fact if the worker then claims to be an employee!

Long-term employees Vera Chapman (almost 2 years) and Krystal Howard (almost 4 years) sought unpaid wages (failure to pay the minimum wage and overtime).

ASUI argued that they did not control the details of the work and that the 1099Misc form designated them as “non-employees” thereby raising a factual dispute as to their employment status. Your editor found that to be particularly interesting---an employer claiming that if we issue a 1099Misc instead of a W-2, it creates a dispute in fact if the worker then claims to be an employee!

Subscribe to:

Comments (Atom)