Long-term employees Vera Chapman (almost 2 years) and Krystal Howard (almost 4 years) sought unpaid wages (failure to pay the minimum wage and overtime).

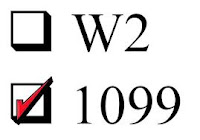

ASUI argued that they did not control the details of the work and that the 1099Misc form designated them as “non-employees” thereby raising a factual dispute as to their employment status. Your editor found that to be particularly interesting---an employer claiming that if we issue a 1099Misc instead of a W-2, it creates a dispute in fact if the worker then claims to be an employee!

The court applied a five-factor test:

ASUI controlled meaningful aspects of its business---placing, funding, staffing, etc.

Uniform purchases by the individuals (ASUI did not provide nor did they pay for uniforms) were negligible amounts compared with ASUI’s business investment.

The opportunity for profit (by the individuals) was solely within ASUI’s control---the hours and rate of pay.

The individuals did not have, nor were they required to have, sufficient skills to exercise independent initiative or control within their roles.

Both Chapman and Howard worked exclusively for ASUI during their periods of “employment.”

The Court ruled in favor of Chapman and Howard---they were employees and not independent contractors. Furthermore, they had not been paid the applicable minimum wage nor had they been paid for their overtime hours. Chapman v. A.S.U.I Healthcare of Texas, Inc. et al, 9DC TX 2012) Civil Action H-11-3025.

No comments:

Post a Comment